Despite a period of technological advancement that has seen traditional petrol and diesel vehicles improve their efficiency, ever more stringent emissions standards, continued growth demand and the large-scale adoption of new materials and engine types is likely to lead to continued change in the automotive industry.

We have witnessed the emergence of hybrid and electric models, as well as the rapid convergence of connectivity and changing customer demands. These unprecedented pressures will likely force the automotive industry to increasingly focus on productivity growth and to find new machining solutions over the coming decade.

Global trends, such as socioeconomic movement toward cities from rural areas, open up new doors for the automotive industry. Urban migration has resulted in different forms of mobility that go beyond the norms seen in Western Europe and North America.

Similarly, new developments in business models and services that rely on the automotive industry have a lasting effect, such as ever-popular delivery services, and we may soon see small electric vehicles, self-driving cars or even AI-powered bots becoming increasingly prominent as the industry strives to adjust.

While these challenges to existing usage models may appear to signal the death of the internal combustion engine, after over a hundred years of evolution these engines have demonstrated their cost-effectiveness and resilience and still offer scope for continued improvement.

While these challenges to existing usage models may appear to signal the death of the internal combustion engine, after over a hundred years of evolution these engines have demonstrated their cost-effectiveness and resilience and still offer scope for continued improvement.

With so much change, it is unsurprising that disruptors – particularly Tesla and Google – often dominate headlines about the future of the automotive industry. There is a clear battle between old and new, but the existing OEMs have shown that they are not out of the race yet.

Earlier this year, Toyota announced that its annual electrified vehicle sales passed 1.5 million, three years ahead of schedule. Similarly, Mercedes-Benz’s new A-Class model was one of the standout examples of cutting-edge technology at the Consumer Electronics Show in Las Vegas earlier this year for its User Experience touchscreen-based infotainment system. Thanks to the influence of outside players, the boundaries between automotive and electronic industries are breaking down and automotive manufacturers need all the help they can get to stay ahead of the curve.

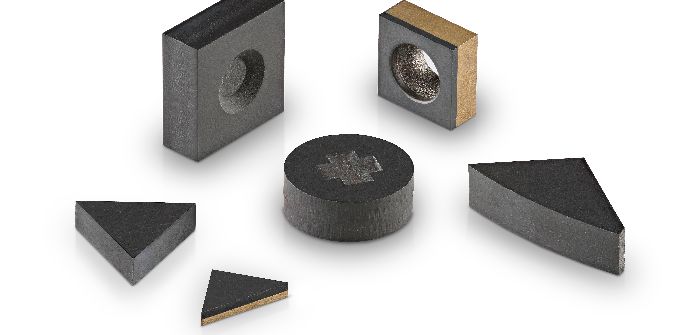

In the ever-changing landscape, manufacturers face daily challenges to improve efficiency, leading to the adoption of lighter and more innovative materials that make the manufacturing process cheaper and faster. In an average car today, there are at least 150 application groups where super-hard materials are used to effectively machine components.

At Element Six, we work in partnership with our customers and OEMs to provide super-hard solutions, including diamond and CBN (cubic boron nitride), that allow for faster and longer machining. However, it’s not just about the material. We bring all parties together to develop the best solutions from ingredient level, right through to multiple phases of testing in varied tooling environments that result in maximum performance.

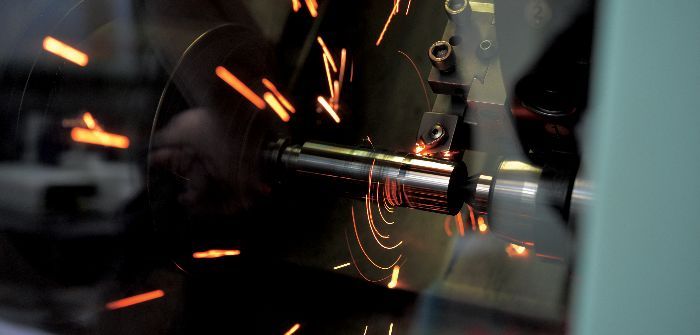

A regular challenge brought to Element Six by customers and end-users is how to maximize efficiency and machining speeds while reducing costs. We launched PureCut, our PCBN (polycrystalline cubic boron nitride) range of specialist machining tools, which we believe offers manufacturers increased toughness, resistance to chemical wear and greater reliability. By eliminating impurities in the materials, the tool life has improved on industry benchmarks by up to 50%, resulting in significant cost savings that make a real difference to the bottom line.

As customers demand greater efficiency, so should you. And with the pace of technological change continuing at speed in the automotive industry, marginal gains for the end user are crucial. Investing in the quality of tools leads to increased machining speeds and productivity at lower costs. Whether you are talking about the automotive industry of now, or of the future, the need to adapt is crucial.