Advances in technology and a drop in green metal prices has seen predictions of EV battery prices falling by almost 50% by 2026. We look at what’s driving this and what it means for OEMs and the wider adoption EVs globally.

The EV battery is an important element in the overall cost and performance of the vehicle. This share has been reducing and that trend is expected to continue according to Statista. Goldman Sachs Researchers expect battery prices to fall to $99 per kilowatt hour (kWh) of storage capacity by 2025, which would be a decrease of 40% from 2022, also estimating that almost half of the decline will come from lower prices for EV raw materials such as lithium, nickel, and cobalt. Battery pack prices are now expected to fall by an average of 11% per year to 2030 with cost parity with ICE vehicles around 2025, even without the benefit of subsidies.

Artificial stimuli such as net zero legislation and cut-off dates for new ICE vehicle sales have their place, but manufacturing physical vehicles and moving them in large enough numbers out of car showroom is its own challenge. Cost may be crucial to EV sales and the closer to price parity the better, but customer appeal is just as important. Furthermore, vehicles undelivered help no one.

Technical innovations

Technical innovations

An EV battery accounts for a substantial amount of the cost of the vehicle and the cathode a substantial amount of the cost of the battery. The costs are cathode material (approximately 35-40%), anode material (10-15%), electrolyte (10-15%), separator (5-10%), battery pack assembly and management system (15-20%). Thus, technical advances in and the chemistry composition of the humble cathode, alone, will make a difference to a vehicle’s retail price and its popularity.

For example, Professor Hailong Chen and his team at Georgia Tech have developed an ultra-low-cost cathode material for solid state Li-ion batteries: iron trichloride (FeCl3), which offers similar energy storage density as with lithium iron phosphate (LiFePO4, or LFP), but with a much lower cost (only ~5-10% of LiFePO4). Chen believes the use of this new cathode will likely cut the cost of Li-ion batteries in the future by a substantial margin.

FeCl3 is used as the cathode in a solid-state cell coupled with a halide solid electrolyte, and a Li-metal or Li-In alloy anode. “It offers a specific capacity of 160mAh/g and a cathode energy density of ~560 Wh/kg. In our preliminary tests, it can cycle more than 1000 cycles in solid cells under room temperature with only 17% capacity loss, which is already very good,” says Chen.

FeCl3 is a widely produced industrial product, mainly used as catalyst and cleaning agent: “The current market price of FeCl3 is only around $700 per metric ton,” says Chen, “While the current market price of LiFePO4 is ~$7,000 per metric ton (which used to be $35,000 before the big drop early this year).”

Meanwhile, Professor Neeraj Sharma and team at UNSW Sydney university have developed a material that can be used to replace graphite electrodes in lithium-ion batteries, using acids such as tartaric and malic acid, found in many foods, as the building block. “Combining these acids with a metal, say iron, results in a metal dicarboxylate. It is this metal dicarboxylate that can replace graphite in lithium-ion batteries. We can provide a drop-in alternative for graphite.”

Energy density is about twice that of graphite, which means less material per battery cell required. Also, the voltage is slightly higher than graphite which means some of the failure mechanisms and safety issues with graphite can be avoided. Furthermore, says Sharma, “It is more sustainable if, for example, the acids are sourced from foods. So, it can also be more cost-effective and much more sustainable in terms of processing.”

Dr Andy Leach, Energy Storage Associate, at Bloomberg NEF is of the belief that there is no one-size-fits-all battery solution: “As the demand for EVs grows, the range of models becomes more diverse, as does the technologies used to power them. Different applications will need different solutions. Recently we have seen CATL announce a multi-technology battery pack with both sodium and lithium-ion batteries in the same pack. Vehicle segments all have different technical requirements with respect to cost, physical size and shape, weight, power density, energy density etc. Therefore, there is no one optimal chemistry.”

Manufacturing and chemistry

The cost of lithium, nickel and cobalt collapsed in 2023 and thus far has not ceased its decline. This is potentially good news for vehicle manufacturers and customers, but there are pitfalls with which to contend. One is fluctuation of course. What goes down can also go up again and just as quickly, and have unintended consequences.

Although, manufacturing costs have reduced along with commodity prices, this has resulted in reduced demand, oversupply and fewer customer incentives.

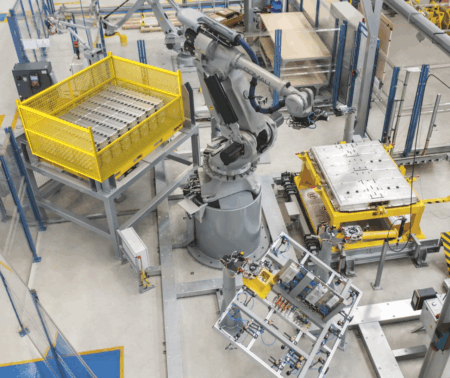

Consequently, weakened demand has led to the delay and cancellation of planned gigafactories and other projects. For example, Northolt has revealed that it has moved its focus away from cathode to cell production capability, and SVOLT recently cancelled construction of a cell project in Lauchhammer, Germany.

In October, Reuters reported that demand for lithium, nickel and cobalt for use in EV batteries had fallen to such bombed-out levels that producers were curtailing output and deferring new projects: “Explosive price rallies in 2021 and 2022 resulted in too much new production capacity being brought online too quickly,” the bulletin explained.

Evan Hartley, Senior Analyst at Benchmark Mineral Intelligence, noted recently that although raw-material supply and demand are generally looking balanced across the rest of the decade, recent low-price environments have meant some mine closures, and with supply coming offline, consequently, “There is the potential for lithium to enter a deficit towards the latter half of the decade,” he says.

Meanwhile, demand for lithium is predicted to grow fivefold in 2030 rising to 14-fold in 2040 as compared with 2020.

The main challenge is the cost of EV batteries according to Andreas Breiter, partner at McKinsey & Company. To overcome that, incentives and a regulator push can help in combination with innovation. That can mean recycling more of the materials in the batteries to make them more affordable: “Innovation in battery chemistry is important because the more we increase the energy density of the battery the more efficient and lighter the vehicle becomes. I think it is a combination of bringing down the cost, continuing innovation and building up the supply chain to make sure there are no major interruptions or price spikes.”

When there is a scarcity, or even a perceived scarcity, of materials the supply and demand side can react to reduce the pressure comments Leach: “On the supply side prices will rise, making more mining projects economical. On the demand side, substitutions will be found, when nickel prices rose and cobalt supply chains were being questioned around the start of the decade, we saw a big shift to LFP batteries which don’t use these materials.”

For Professor Jay Whiteacre, Carnegie Mellon University, it depends on what is causing limited supply and how much demand is going to be going up in the next decade or so. “For example, there’s plenty of lithium in the crest of the earth. We’re not short of lithium, but we could be short on the extraction and processing of lithium in an intermittent way. It depends on how fast industry is trying to right size demand for critical materials with production. And it swings back and forth quite a bit.”

Of the rarer materials cobalt is particularly limited both in terms of availability and location. Consequently, many companies are moving toward cobalt free or very low cobalt chemistries. Researchers are also trying to reduce the amount of nickel, another limited commodity. Lithium, iron, phosphate battery chemistries just use iron and phosphorus and oxygen, which are really appealing, although they have challenges because of their lower in energy density.

“There’s a bunch of trade-offs, I guess,” says Whiteacre. “I don’t think there’s a single answer to that or a single solution. There’s a portfolio of battery chemistries that are being developed that could respond to different kinds of shortages or different kinds of issues in the supply chain. There are options that are all being moved forward, and we’ll see if they continue to move in parallel. If some die off, if some are scaled up, we’ll see what that happens.”

Structure of battery packs

Structure of battery packs

The design of cell-to-pack is different depending on the shape and dimensions of the cells says Chen. “It’s hard to say which one is better. Commonly, the cylindrical cell pack design allows for better cooling, while the pouch cell packs offer a slightly higher volumetric energy density.”

He notes that once solid-state batteries advance to the stage that they can be widely used in EVs, the cell-to-pack designs can be very different from current ones because of the all-solid-state configuration and the fact that they can function within much wider template window than current LIBs, so the associated heating and cooling systems can be much simpler and cheaper.

James Eaton CEO of Ionetic, a company that specializes in software-accelerated custom-made battery pack development, believes in a custom incremental approach to make sure that the voltage energy power cost is what is needed: “I think there is a theoretical answer that is cell to pack: get yourself a really big prismatic cell and bond it directly into the vehicle. The reality is unless you have hundreds of millions of pounds to spend. That’s not the best solution.”

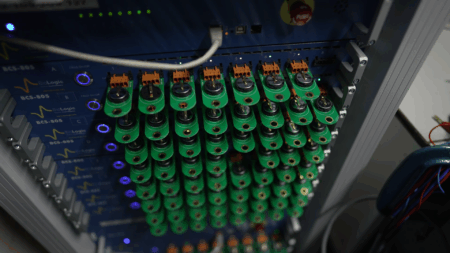

Nyobolt produces pouch cells which, although they are not that different from standard assembly concepts, the proprietary Anode and Electrolyte material enables, in combination with the company’s cell and pack design, dedicated BMS and charging infrastructure, the ability to deliver extremely fast charging and the downsizing of the batteries as a result.

Ramesh Narasimhan, EVP Nyobolt, believes it’s important for fast charging infrastructure to grow and is expecting this to come in the next three-five years. This will enable the move towards smaller fast charging batteries and more cost-effective vehicles.

“Now we are trying to change the mindset of the car industry to switch focus from long-range and big batteries and instead aim for smaller batteries with a longer lifespan, faster-charging, both reducing material consumption, CO2 footprint as well as removing the barriers that might be stopping customers switching to electric.”

Another fast-charging solution, StoreDot’s XFC (eXtreme Fast Charging) battery technology, relies on silicon-dominant anodes, replacing graphite and enabling faster ion movement, leading to quicker charging. The current technology enables 100 miles (160 km) of range in five minutes, whereas100 miles (160 km) of range in three minutes is target.

20-30 Vision

Whiteacre foresees the arrival of a truly disruptive cobalt-free, low-nickel solution into the marketplace: “That will change the way people design packs because it’s a safer material that’s still energy dense.”

More generally the search is on for the best way to scale the entire industry from charging infrastructure and electrical provision all the way to building enough factories in the right places that use the right materials globally. Eaton does not see energy density or charge times as barriers to consumer entry into the EV market, but cost: “I think as EVs get cheaper they will get adopted. It’s just a case of bringing costs down along with incremental increases in energy, density, and charge times.”

Dr Jingyi Chen, Head of Battery, Breathe Battery Technologies, which provides adaptive charging software that optimizes battery lifespan and charging speed, sees the battery industry shifting toward a foundry model, similar to the semiconductor sector, as car manufacturers seek more control over cell design instead of relying on cell manufacturers to determine technology and performance parameters: “This transition will redefine the value chain and open new avenues for innovation. Recent trends already indicate a decline in EV battery costs, driven by technological advancements and economies of scale. This reduction is set to continue, making electric vehicles even more accessible, in turn making improved charging experience for customers even more important.”

There are certainly aims to solve a variety of challenges, such as energy density, range, safety, performance and chemistry, but balance is elusive given the requirements of different applications. So, keeping costs down and performance up may entail a rich colour palette from which to chose rather than expect the perfect battery.

For now, battery prices are declining, but the last few years have taught us not to be complacent or be fooled into thinking that oversupply couldn’t have negative consequences in the long term. Gigafactories are needed to meet anticipated demand, which can’t be met if projects are delayed or cancelled. Swings and roundabouts – erratic supply trying to meet fluctuating demand. We have a snapshot of the market that appears both buoyant and stable, but a snapshot is what it is. Customers will want to buy cars with batteries with all safety, fast-charging, energy density bells and whistles in a vehicle with performance and cost parity with their old family ICE car. Why shouldn’t they? If a change in driving habits is required, Greater expense and lower performance or safety won’t be tolerated by the buying public. Consequently, when the price tipping point occurs, it needs to be maintained.