Words: Dr Frank Millard

Battery swapping in EVs has several advantages. These include a low cost and high speed. Plus, a battery pack does not deteriorate as quickly when swapped, as opposed to DC fast charging, which can affect the lifetime of the pack. However, the reluctance of some OEMs to share or standardize across a wide range of vehicles and types has prevented a good idea from being realized up until now.

The competition between battery swapping and fast charging does not have to mean success for one at the expense of the other. Khaled Hassounah, CEO and founder of Ample, envisages that both technologies will have a place in the future, just as wind and solar power are both effective ways to generate renewable energy. “Use-case and utilization are likely to be the most critical factors,” he says. “Fast chargers are important for drivers that have a spot to charge their car at night or during the day but need a way to achieve a higher range or use a fast charger occasionally. Battery swapping is likely to be more relevant for people who don’t have a place to charge reliably overnight or during the day, and hence they need rapid recharging as the primary way to get energy. Or for fleets for whom higher utilization or cost of building full infrastructure is important.

“We expect that as technologies scale, there will be some colocation, although generally, fast chargers will be concentrated where there is enough available power, especially along highways, whether close to the city or further. Battery swapping will be easier to deploy where power is a challenge (e.g., inside large cities) and will be less dependent on grid connection along highways, given the possibility of relying more on renewable energy installed next to stations.”

Matteo Del Sorbo, executive vice president, Magna International and global lead for Magna New Mobility, also sees battery swapping and fast-charging existing in parallel for some time, as the transition to electrification around the world continues to develop. This, however, he believes is easier with two-wheeled vehicles than with four.

“Size of battery, range and cost will continue to impact acceptance rates for both options but today swappable batteries have clear advantages with micromobility versus automotive vehicles,” he says.

Hui Zhang, vice president of NIO Europe, says that NIO cars are compatible with type-2 charging and CCS standards, so they can either be charged at charging points, or users can opt to swap their vehicle’s battery: “We believe in providing the best holistic charging and swapping experience for users,” he says. “To support this, NIO has its own charging and swapping network, as well as connections with third-party charging networks.”

Innovation station

Innovation station

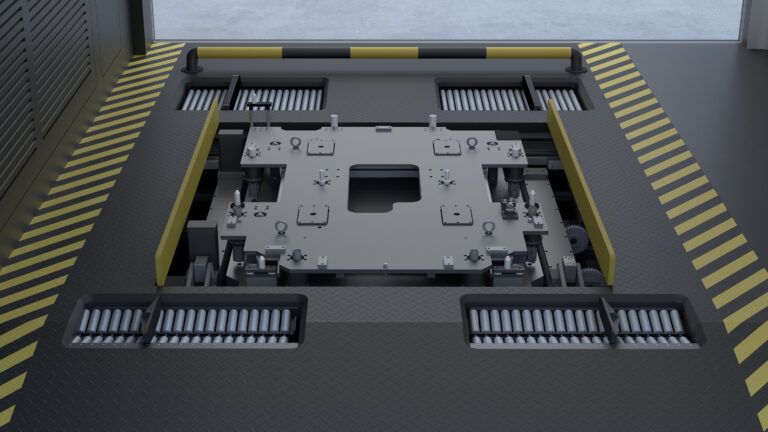

The NIO Power Swap Station (PSS), the world’s first mass-produced battery swap station, is intended to solve EV-user range anxiety. Taking less than five minutes, it is quicker and more convenient than refueling at a gas station.

“Enabled by more than 1,400 patented technologies, the fully-automatic solution swaps depleted batteries for those that are charged without the user needing to leave their car,” Zhang explains. “It offers convenience and speed, which is unique in the EV market.”

Battery availability and queueing status is shown in real time via the NIO App. So, should there be a queue at the swap station, the driver will be made aware of this automatically when within 200m of the PSS. They will also be notified about their changing position in the queue and when their turn comes.

NIO PSS 2.0 has a capacity for 14 batteries – 13 containing battery packs, and an empty slot to pick up a discharged battery. Each PSS can provide up to 312 battery swaps per day. A PSS can be deployed in any outdoor parking space that can park four vehicles and has enough grid capacity.

All NIO swapping/charging facilities are connected and monitored by NIO Power Cloud.

NIO PSS has 202 sensors, 37 cameras and 21 TOPS of computing power. It can detect and monitor situations like temperature, humidity, flooding, surge, short circuit, leakage, grounding, general security, fire safety, smoke.

“During the day, the batteries are charged through DC fast charge at a speed of 40 kWh. At night we charge the battery at a slower rate to extend the longevity of the batteries. They can swap for a charged battery in around five minutes,” says Zhang. “From a PSS, the battery’s state of charge (SoC) will generally be above 90%. This is done in consideration of the battery’s life. For the long-term health of the battery, we advise users to only charge to 100% when doing long journeys.”

Modular approach

Modular approach

Another pioneer in modular battery technology, Californian company Ample, has been working on battery charging for the past seven years without fanfare and has got around the standardization issue. The company has five operational charging stations in California, with more planned.

The company uses modular battery swapping to deliver a fully charged pack in under 10 minutes, which is three times quicker than by fast charging. It now plans mass deployment across the USA and Europe.

“Battery swapping has been adopted in Asia as a solution for various types of vehicles, from two-wheelers to trucks, as a way to solve the EV infrastructure problem at scale, says CEO and founder, Khaled Hassounah. “Two- and three-wheeler solutions require that vehicles can use a standardized module. For larger vehicles, we see OEMs developing proprietary systems for their batteries or new vehicles that can use a swappable battery.”

Ample’s modular battery swapping approach, also has benefits not associated with traditional pack battery swapping. Modular battery swapping doesn’t require car manufacturers to change the design of the cars they produce. Ample’s modular batteries are designed to fit in the same space as the original battery.

“This means EV manufacturers can stay focused on just developing the car, as is the case for manufacturers of petroleum cars, and they don’t have to worry about charging infrastructure, allowing for fast adoption,” explains Hassounah. “Modular battery swapping also enables the stations to be used by vehicles from different manufacturers and different formats vehicles (cars, vans, trucks).”

Micromobility solutions

Micromobility solutions

Brand compatibility is more of an issue for some vehicles than others. Other considerations are cost and convenience, which influence the enormous two and three-wheeled market in Asia. Battery sharing is the best option here, where there are fewer charging points than in Western urban settings. Plus, battery leasing and two-wheeler sharing models are becoming particularly appealing across the world in terms of convenience and cost.

China is the world’s largest producer of two-wheeled electric vehicles, with exports increasing year on year. However, Taiwan is also a major producer and exporter. About a quarter of all new scooters sold recently were electric and about 97% of those were either Gogoro scooters or powered by Gogoro’s batteries and charging infrastructure.

Gogoro battery swapping is focused on the refueling of urban two-wheeled vehicles in densely populated cities where parking is limited, and time is constrained.

“Because of these key needs in cities, fast-charging will struggle to succeed,” says Jason Gordon, VP of communications at Gogoro. “Many of the same plug-in charging issues still exist in terms of dedicated parking for charging and the time it still takes to charge, which is dramatically greater than the seconds it takes to swap.”

Meanwhile, Magna says micromobility presents a great opportunity for growth beyond traditional vehicles and is working together with Yulu, India’s largest electrified scooter-sharing provider, to expand into this sector. India is one of the fastest growing markets for electrified two-wheeled mobility. It has about 200 million petroleum-powered two-wheelers on the road and the Indian government has a stated vision to transition the market to electric-powered two-wheelers by 2030.

Twenty million new two-wheelers are produced in India each year, of which a small minority are currently EVs, but production is growing quickly.

Sorbo says the company will initially focus on India but will take the business model – BaaS (batteries as service) and potentially Maas (mobility as a service) – to other markets in future.

“As governments continue to support electrification with incentives and policy changes, battery swapping will grow as an important solution in micromobility, especially in two-wheel and wheel-wheel vehicles,” says Sorbo.