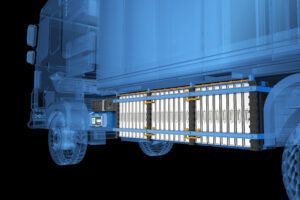

How are heavy-duty vehicles faring in the long drive towards electrification? Their immense batteries pose some fiendish challenges, but a first-generation of on- and off-highway battery-electric vehicles exceeding 20 tons are already available, while new charging-management techniques and battery chemistries mean an even more efficient future generation of larger vehicles is already on the horizon, as industry experts explain.

Larger vehicles were once thought poor candidates for full battery electrification. The batteries would forever be too voluminous and weighty, too costly. There were doubts that they could generate sufficient power to haul tremendous payloads. And, even if they did, problems around battery degradation would mean rapid declines in performance making costs impractical.

But, on the highways of California and the autobahns of Germany, some electric heavy-duty trucks, from the likes of Volvo and Tesla, are already sailing breezily past the diesel-powered competition; over half of London’s iconic red buses are electric, hybrid or hydrogen; electric excavators are gradually getting larger with models exceeding 20 tons from Volvo CE and Komatsu; and, after a slow start, electric tractors are starting to work the fields.

The push for Net Zero, and the government incentives involved, are one side to this story. Another is improved power, performance and acceleration. Here, some of the world’s top experts explain the groundbreaking new research in both battery management and chemistry, that are helping to push toward more efficient electrification solutions for ever larger vehicles.

Why have electric trucks?

Why have electric trucks?

“Diesel trucks are challenging to drive – they’re slow, very slow. On highways, they can’t even get up hills without going down to 30mph,” says Sam Evans of EV News Channel, Electric Viking. The electromechanical PTO (power take-off) provided by EV motors is highly suited for pulling loads. A conventional Class 8 (the US definition of a truck between 33,001-80,000 pounds, or 14,969-36,287kg) takes a whole minute to go from 0-60mph, but the top performing electric equivalent cuts that down to 20 seconds even under a full load. Such a vast improvement can facilitate improvements in traffic flow, and shorten journey times, and make for a far less frustrating experience for other road users. This impressive PTO has advantages over a range of commercial operations, from agriculture, to dumping and loading and public transit on steep roads. But the bottom line is reduced operating costs. Fueling these workhorses is on average 80% cheaper, and maintenance 43% cheaper. Even with up-front costs 186% higher for an electric Class 8 semi-truck, the total cost of ownership (TCO) can be $200,000 less over the course its lifetime. However, the electrification of larger vehicles comes with some tricky engineering challenges, and a huge flurry of activity in research, design and manufacturing in this sector, is underway.

There are two kinds of longevity, the number of charge-discharge cycles a battery can undergo before failure: cycle life. Then there’s how long it takes to degrade over time, even while idle: calendar life. Because commercial vehicles are in constant use, the cycle life is the more crucial metric.

“Understanding battery degradation is more important for heavy duty applications, for numerous reasons,” says Greg Offer, professor of electromechanical engineering at Imperial College London, and a former civil servant advising the UK Government on low carbon technologies.

One of these reasons, is the manner in which heavy-duty vehicle operators use their batteries.

“For passenger electric vehicles, the way you’re using the battery is pretty tame. We use the term C Rate, which is how quickly, how aggressively you’re using that battery,” says Offer.

1C means that the battery gets fully charged or discharged in one hour. If its 2C, then its half an hour. At 0.5C its 2 hours. So, the higher the C, the faster, more aggressive, the charge, and the more quickly the battery will deteriorate if repeatedly used in this way. Today’s batteries will easily handle 0.5C and under, experiencing only gradual loss of maximum capacity at those C-Rates. “The only really aggressive use, is when you fast charge,” says Offer.

Some of the leading electric freight manufacturers advertise that it is possible to charge their battery 0-100% in half an hour. That’s 2C, and it represents a lot of stress on the battery. So, the trade-off is this: minimise down time from charging, but at the cost of the battery’s overall lifespan.

In commercial operations, particularly freight, owners tend to want to recoup their investment as quickly as possible, which means a lot of heavy constant use and a lot of fast-charging. This is to keep down-time to a minimum. “We’re seeing applications where they will be fast charging routinely, every day,” says Greg.

This heavy usage threatens to undermine the economic advantages of electrification, not least because the battery already represents up to 40% of the entire cost of the investment. If the battery needs to be replaced, or the vehicle retired early, that’s a big issue.

Making batteries last longer

Making batteries last longer

Oxford researcher Christopher Birkl, is CEO of the university’s spinoff company, Brill Power. Working with Professor David Howey he has come up with a groundbreaking new solution to overcome the broader longevity problem, one that may be of particular advantage for heavy-duty EVs.

“First, we physically measured the capacity of the batteries that had been discarded, and we found that 50% of cells had more than 70% of their entire storage capacity left,” says Birkl.

Individual variations among the many thousands of cells in a battery can cause some to degrade faster than others. This may be due to slight differences in chemical balance, irregularities in manufacturing, and exposure to temperature extremes whilst in use.

“If those individual cells degrade differently, then you’re always limited by the weakest link in that chain,” says Birkl. Furthermore, as a cell degrades, its smaller capacity will ‘fill up’ faster. So its effective C-Rate increases, and the same charge is experienced as more stressful on the battery. This creates a runaway feedback loop. The cells that deteriorate faster have progressively higher C-Rates, they degrade even more, experiencing even higher C-Rates, until eventually, the weakest link breaks.

“But we’ve come up with the underlying technology for Brill Power, a new way of controlling batteries,” says Birkl.

This technology sees circuitry connected to each of the thousands of cells, every one of which has its charging speed automatically modulated. No software is involved. As a cell degrades, this technology ensures that it is charged more slowly than its healthier counterparts. This means that the C-Rate remains constant for every cell in the battery.

“So weaker cells will be used less intensively and stronger cells more intensively. And in that way, you never get that situation where one cell can bring down your entire battery,” says Birkl.

With conventional ‘passive balancing’, the weaker cells reach their maximum charge first, and then dissipate the extra energy via resistors while the others catch up. That extra energy would be utilised evenly under this technology, leading to a faster, more efficient charge.

The effect of the breakthrough could be drastic, with a game-changing 60% increase in cycle life longevity. Such a leap may alleviate many of the durability concerns in the heavy-duty EV landscape. Furthermore, these improvements draw upon fairly standard components, comparable to those already in use, so will be straightforward to manufacture. Any increase in capital cost will be more than compensated by significant savings in total cost of ownership.

Chemical equations

“It’s not just about what the technology can do. It’s about the newcomer versus the incumbent, and the costs of industry shifting over to a new battery chemistry,” says Offer. There’s no shortage of new developments here. The regular announcements of bold new combinations of cathode, anode and electrolyte material set to revolutionise the industry can be bewildering. It can be difficult to discern the next big thing from the hype.

“If the top six battery manufacturers aren’t doing it, it’s not commercially viable. It’s really that simple,” says Evans.

In the end, it comes down to two competing variations on the lithium-ion battery, with a third sodium-ion based solution on the horizon. In the Li-ion corner is the relatively mature rare-earth intensive nickel-cobalt-manganese (NCM) chemistry; along with the cost-effective challenger, lithium ferro-phosphate (LFP), which has gone from a 30 to a 64% market share in two years.

“The jury is still out. There’s differentiation in the marketplace, so you’ll probably have premium vehicles using NCM and the cheaper vehicles using LFP,” says Offer.

Unexpectedly, the sodium-ion battery (SIB) made a first-generation commercial debut in 2023, with a number of cost-effective models rolling off the production line. Rather than expensive, relatively rare lithium, it uses an electrolyte derived from salt, one of the most abundant resources on earth.

NCM gives up to 2,500 charge-discharge cycles, compared to LFP’s 10,000, and SIB’s 5,000. Sodium-ion is first generation, so likely to improve, while NCM, as a mature technology, may have peaked. LFP is just hitting its stride. What does all this mean for heavy-duty vehicles? The benefits of increased longevity form an outsized advantage for the larger batteries, so LFP’s higher cycle life currently fits the bill for the battery chemistry that will deliver those whole lifetime guarantees for larger vehicles. Sodium-ion may be a decade away from full scalability, and on the face of it, its greater bulk, lower energy density, and middling cycle life, is not best suited for the larger EVs. However, there are tentative indications from India that SIB will be the battery of choice in buses. The sheer scale of electrification in developing countries may accelerate adoption of the cheap, more abundant option.

The future is massive

The future is massive

As of 2023, the electrification of large vehicles has never looked more promising. With sodium-ion firmly in the picture, the price and availability of lithium is no longer the limiting factor it was once thought to be.

“We’ve seen really encouraging signs just in the last few years, it’s partially driven by some regulations that are just kicking in. Also, there’s an acknowledgment that this is a viable way to make money,” says Offer.

Battery longevity remains the challenge. But one that is firmly in the crosshair of the research community, and a need which is well understood by manufacturers. The pace of change can be exhilarating, and with the technology that’s in the pipeline, we could be about to see an immense leap to massive electrification.