The EV market is booming. The battery is a key feature for both cost and performance, the chemistry and cell levels are extensively discussed. However, everything else that goes into a pack is often overlooked.

A key area is the thermal management, maintaining the temperature is essential and will become more significant for both performance and with the rise of up to 350 kW fast charging. IDTechEx has released two new market reports providing a technical analysis within this industry: Thermal Management for Electric Vehicles 2020-2030 and Thermal Interface Materials 2020-2030. This article will highlight some of the analysis of for Thermal Interface Materials (TIM) for electric vehicle battery packs.

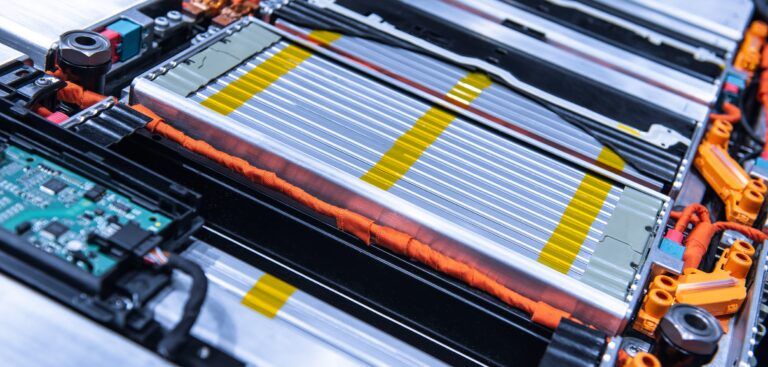

IDTechEx forecast the battery demand for electric plug-in passenger cars to exceed 300 GWh by 2025 and nearly triple that by 2030. At pack and module level (beyond the cell) there are huge material opportunities; a key part of this is how the cells are protected, connected and allowed to dissipate heat. TIM are used to facilitate thermal transfer, usually between a heat generating device and a heat sink. In the case of a battery pack, this is usually from the cell or module to a heat sink. The TIM is typically a ceramic filled polymer matrix (e.g. alumina filled silicone) and is usually a gap pad or a filler.

However, practically no EV battery pack has the same design from the cell form (cylindrical, pouch, prismatic) to what, if any, thermal management employed. The thermal management employed is typically air, liquid, or refrigerant in either an active or passive capacity. Immersion cooling is an additional emerging opportunity outlined in the report, that is just beginning to find market some small market traction. The location of the TIM can also vary widely as shown in the image below.

There are also numerous material considerations: through-plane conductivity, viscosity, adhesiveness, compressive strength, lifetime, and more. Then there are the factors of cost (some players trying to drive this down to $10/kg!), application method (shift to fillers over pad is being observed), and the wider manufacturing impact (silicones are not popular in the automotive community because of their outgassing).

IDTechEx forecast this to be the largest TIM sector by volume 2030 with 100s ktpa in demand. As a result of this burgeoning demand, the market players are preparing either through partnerships, market launches or acquisitions. The acquisition of Bergquist by Henkel in 2014 was one such move and in 2019, the major acquisition of Lord by Parker Hannifin is another significant development.